The Newsletter of Topsail Capital Advisors

June 2025 Edition

Current Trends in U.S. Middle and Lower Middle Market M&A

Executive Summary

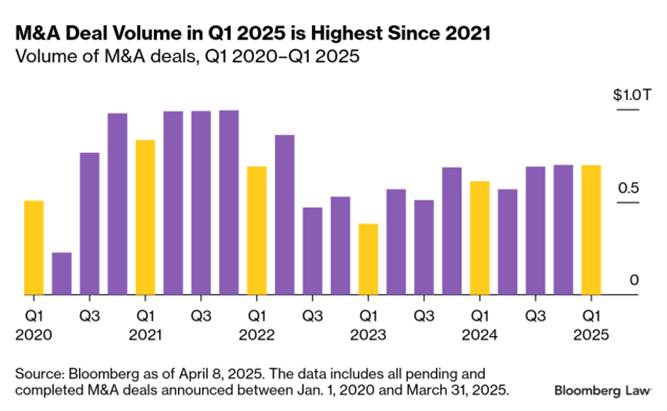

U.S. M&A deal counts declined by 19% in Q1 2025 compared to Q4 2024, indicating market uncertainty. Despite fewer deals, total announced deal value increased by 8% quarter-over-quarter, with March 2025 marking the highest monthly aggregate in three years at $340 billion.

Axial reported a 20.3% year-over-year increase in lower middle market deal flow, totaling 3,049 deals—the second-highest quarterly total in its history. PE buyers accounted for 41.4% of deal volume in the business services sector, the highest since 2022.

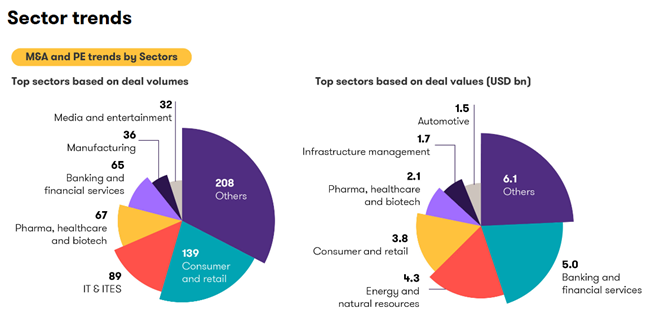

Market Trends & Sector Highlights

Middle Market Overview

Total deal value rose by 8% in Q1 2025 compared to Q4 2024, despite a 19% drop in deal counts, suggesting a focus on larger transactions. Technology, healthcare, and financial services sectors showed resilience, with notable consolidation activities.

Interest Rates & Financing Environment

Rising interest rates on lower middle-market and middle-market deals have increased the cost of capital, influencing deal structures and valuations. Buyers are exploring alternative financing options and deal structures to mitigate the impact of higher borrowing costs.

As of May 2025, the interest rates for SBA loans typically $5 mil and under (“main street” and lower-middle market) vary depending on the type of loan and the amount borrowed:

- SBA 7(a) loans: Interest rates for these loans are typically based on the prime rate plus 2.25–2.75%. The median interest rate for fixed-term loans is 12.50–15.50%, and the median interest rate for variable-term loans is 10.50–14.00%. The interest rate may also depend on the loan amount and maturity:

- $25,000 or less: 11.75% for loans with a maturity of less than 7 years, and 12.25% for loans with a maturity of more than 7 years

- $25,001–$50,000: 10.75% for loans with a maturity of less than 7 years, and 11.25% for loans with a maturity of more than 7 years

- $50,001 and up: 9.75% for loans with a maturity of less than 7 years, and 10.25% for loans with a maturity of more than 7 years

Due Diligence Trends

Buyers are conducting more thorough due diligence, focusing on financial health, legal compliance, and operational efficiency. Environmental, Social, and Governance (ESG) factors are increasingly integral to the due diligence process. Due diligence is a broad concept that can cover a significant number of areas. Due diligence can be performed in different ways—e.g., by internal teams, external advisors, specialists, experienced/senior industry players or, as is often the case, by a combination of the above, leveraging the buyer’s knowledge with the deep transaction experience of M&A and industry professionals.

Many companies approach diligence as a high-level analysis limited to a search for “red flags,” deal killers or fatal flaws. While that may be an appropriate starting point based on time and cost, a comprehensive approach includes more detailed analysis of the target’s information, industry, and economic outlook.

Beyond the fatal flaw analysis, due diligence can surface fundamental insights, risks, and exposures that can have a significant impact on valuation, the terms of the transaction agreement, culture/people risks, technology, operations or the regulatory environment that can materially change a buyer’s interest in or valuation of the deal. A structured due diligence process can also help management assess the likelihood of the success of, and limit surprises during, the post-transaction period.

In the lower middle market, buyers are more cautious and thorough than ever before during the due diligence process, making it even more important for owners to have a qualified M&A Advisory firm on their side when they go to market. We are seeing longer due diligence and buyers requesting the owner have at least three years of Quality of Earnings (Q of E) or audit financial statements as part of the seller’s requirement. We are also seeing an increase in the percentage of “rollover equity” along with larger seller notes and earnouts associated with specific size deals and sectors.

If the company has a highly concentrated customer base and is not diversified, this is also seen as a “red flag” as of recent with buyers, Private Equity, and lenders such as SBA. The same goes for non-contract-based work, particularly in the service and transportation sectors. At Topsail Capital Advisors we start with a Market Valuation and Exit Planning (MVEP) process which inherently reduces due diligence timing, increases owner value, and decreases the risk of the deal falling through during due diligence or Letter of Intent stages.

On This Day – Notable Mergers & Acquisitions in May

May 1

- 2019 – First Citizens Bank completed its merger with First South Bancorp, Inc. and its subsidiary, First South Bank, expanding its footprint in North Carolina. First Citizens

May 2

- 2011 – Southwest Airlines finalized its acquisition of AirTran Holdings, Inc., enhancing its presence in key markets and expanding its low-cost carrier model. Southwest Airlines Investor Relations

May 3

- 2024 – ExxonMobil completed its $59.5 billion acquisition of Pioneer Natural Resources, significantly increasing its assets in the Permian Basin.

- 2023 – Darden Restaurants announced its $715 million acquisition of Ruth’s Hospitality Group, bringing the upscale steakhouse chain Ruth’s Chris Steak House under its umbrella.

- 2024 – Burke & Herbert Financial Services Corp. completed its merger with Summit Financial Group, Inc., creating a more robust regional banking institution. DealroomDarden Investor Relationsinvestor.burkeandherbertbank.com

May 4

- 2023 – First Horizon and TD Bank mutually agreed to terminate their proposed merger, citing regulatory uncertainties. SEC

May 7

- 1998 – Daimler-Benz announced a $36 billion merger with Chrysler Corporation, marking the largest acquisition by a foreign buyer of a U.S. company at that time.

May 8

- 2020 – AbbVie completed its acquisition of Allergan plc, known for products like Botox, in a deal valued at approximately $63 billion, diversifying its pharmaceutical portfolio.

May 28

- 2007 – Blackstone Group’s $26 billion acquisition of Hilton Hotels Corporation was announced, marking one of the largest leveraged buyouts in the hospitality industry.

May 31

- 2001 – Microsoft acquired NCompass Labs, a Canadian internet software company, for $36 million, enhancing its web content management capabilities.

On a Lighter Note: The Chicken Coop Clause

In a recent lower middle market deal in rural Georgia, a business broker shared a story that proves due diligence sometimes extends far beyond the balance sheet.

During the sale of a small landscaping company, the owner insisted on adding an unusual clause to the purchase agreement: the buyer had to agree to continue feeding the owner’s prize chickens that lived behind the shop—for at least a year.

The chickens weren’t part of the business, nor were they particularly valuable. But the seller claimed they brought “good cluck” to the company and had been his morning companions for 12 years. The buyer, amused but agreeable, even renamed the clause in the final agreement: “The Egg-xecutive Producer Provision.”

Moral of the story? In the lower middle market, it’s not just EBITDA and add-backs—sometimes it’s also about eggs and backyard birds.

Contact Us

For more information and to receive a sample copy of our Market Valuation and Exit Plan (MVEP) or to conduct a confidential introductory call with one of our Principals to assess your options.

Topsail Capital Advisors

103 N Main St, Ste 302

Greenville, SC 29601

Phone: (864) 320-9442

Email: admin@topsailcapitaladvisors.com

www.topsailcapital.com

Firm Member of the Alliance of Meger & Acquisition Advisor and the Certified Commercial Investment Institute.

Sources: Axial, Pitchbook, Deloitte, RL Hulett