M&A Market Trends: What’s Happening Now?

The M&A market in early 2025 has shown resilience despite economic fluctuations. Lower middle market transactions are seeing steady deal flow, with strong buyer demand in industries such as healthcare services, niche manufacturing, and business services.

Recent deal highlights:

- A specialty HVAC service company with $3M EBITDA recently sold for a 4.8x multiple to a private equity-backed strategic buyer.

- A regional IT managed services provider with $1.5M EBITDA was acquired by a larger competitor for a 5.2x multiple.

- A precision machining business with $2.2M EBITDA went to an independent sponsor for 4.5x multiple, with an earnout based on revenue growth.

Valuations remain strong for companies with solid financials, diversified customer bases, and strong leadership teams in place. Buyers continue to show caution in cyclical industries but are aggressively pursuing stable, recurring-revenue businesses.

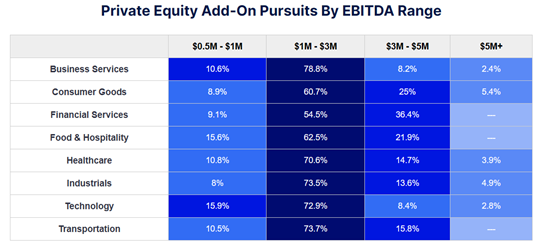

The below illustrates Private Equity Add-On Pursuits by EBITDA Range at the end of 2024. As you can tell from the chart in the $1-3 mil EBITDA range Business Services, Industrials, and Transportation took the top three spots. Financial Services, Consumer Goods, and surprisingly Food and Hospitality took the top three spots in the $3-5 mil EBITDA range.

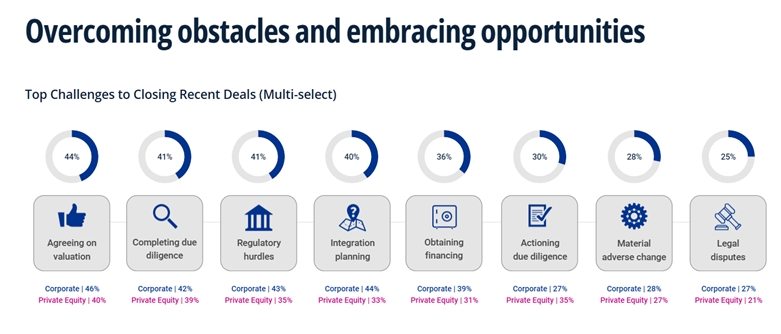

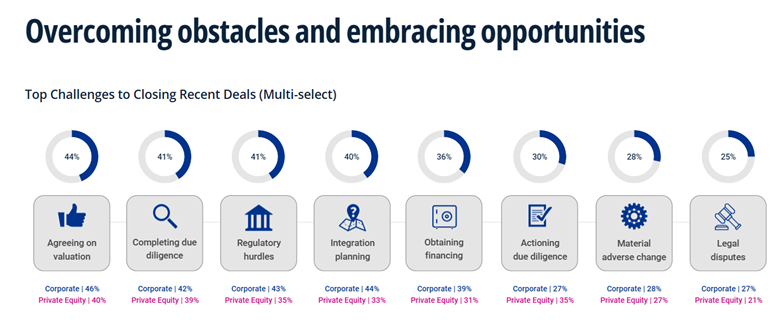

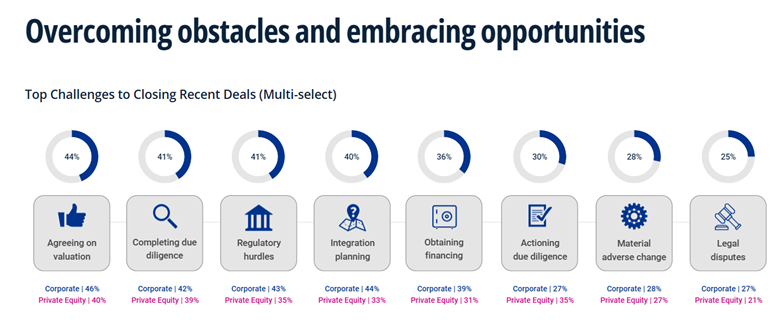

As you can see from the illustration below, it is essential for owners to be property prepared for the market by working with an experienced and qualified M&A Advisory firm. The top challenge for both Corporate and Private Equity regarding closing deals was Agreeing on Valuation. The second hurdle was Completing the Due Diligence, while the third was Regulatory Hurdles. This is why TCA has spent years developing our Exit Planning process for owners. Our Market Valuation and Exit Planning (MVEP) document not just establishes a strong case for current Enterprise Value, but places your business in the best light possible, historically and into the future. We take the time to examine your vast business fundamentals and industry KPI’s and offer suggestions on how you can “work out the kinks” of major issues that may pop up during the deal process eliminating risk and reducing anxiety.

We build your due diligence vault so that when the comes, either sooner or later, you are fully prepared. Our MVEP works much differently than a CPA’s “book valuation”. The CPA book valuations have their place, but our MVEP is a moving or live document, constantly updated and expanded upon. Think of TCA as an Attorney if you were to go to court. We build your case with as much detail as possible so that when the verdict comes in there is uncanny evidence in your favor.

After all, the Private Equity Groups, Corporates, and Independent Sponsors job is to find ways to “de-value” your company in their favor. When TCA’s takes your company to market, you can be assured your business will be seen in the best light possible. We manage all aspects of the deal from the initial MVEP, to creation of the Confidential Information Memorandum (CIM) package, setting IOI/LOI dates, placing the Teaser on major outlets, sending the Teaser to a targeted list of acquiring prospects, to negotiating all terms, and managing deal flow and communication between all parties involved. We look forward to sending over a sample of our MVEP document along with our targeted questionnaire to examine your options.

*Source KPMG 2024 M&A Deal Market Study

Exit Planning: Why Business Owners Should Start Now?

Selling a business is one of the most important financial events in an owner’s life. Yet, too many wait until the last minute to think about their exit strategy.

Why early planning matters:

- Maximizing Value: Buyers will pay a premium for businesses with clean financials and well-documented processes.

- Reducing Deal Risk: Preparing in advance helps avoid last-minute surprises that can derail a sale.

- More Buyer Options: With time, owners can attract multiple buyers, increasing leverage in negotiations.

Owners should begin exit planning 3–5 years before they intend to sell. A professional M&A advisor can help assess value, optimize financials, and ensure the business is presented in the best possible light to attract premium offers.

Testing The Temperature of What to Expect in 2025

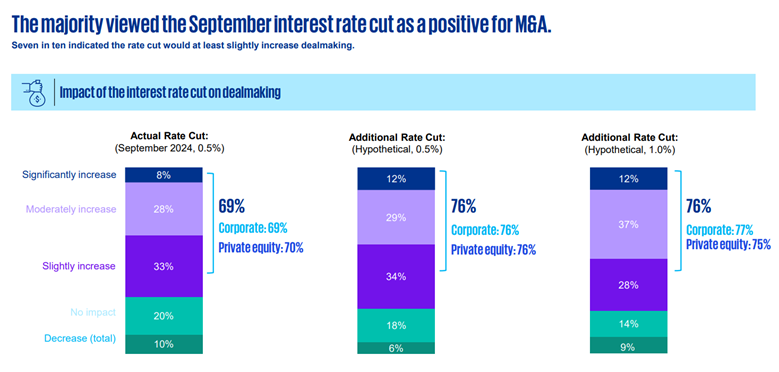

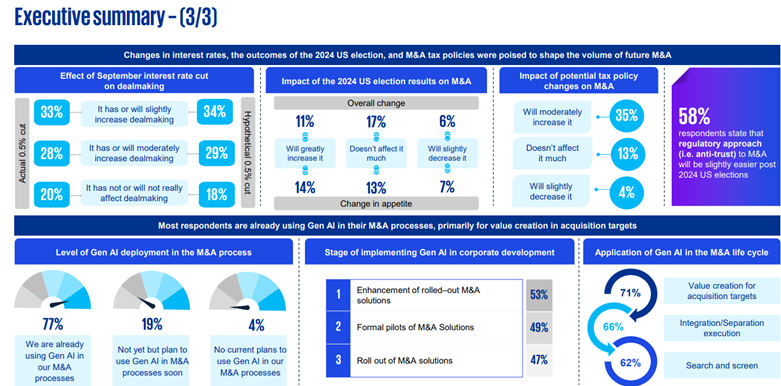

Below you will see several key factors regarding interest rates, the results of the 2024 Presidential election and impact regarding tax policy changes in M&A. Respondents regarding interest rate cuts indicated a range of 34% increase in deal activity entering 2025 based on interest rate cuts in mid to late 2025. 29% indicated they will moderately increase dealmaking, and 18% indicated rates will not really affect dealmaking.

The second category involves whether the results of the election will affect their M&A activity leading into 2025. 17% said that the results will not affect, while 11% responded that it would greatly increase, while only 6% indicated that the results would decrease activity.

*Source KPMG 2024 M&A Deal Market Study

*Source KPMG 2024 M&A Deal Market Study

Selling a business The Lighter Side: M&A Horror Stories – The Buyer Who Vanishe can be a rollercoaster, and sometimes, deals take unexpected turns. One seller we worked with received a lucrative offer from a well-funded buyer. Everything looked perfect: letters of intent were signed, diligence was progressing, and closing was just weeks away.

Then—poof! The buyer disappeared. Emails went unanswered, calls went straight to voicemail, and the attorney representing them had no clue what had happened.

It turns out the buyer, in their enthusiasm, had neglected to get lender approval before making the offer. When the bank refused to finance the deal, the buyer panicked and went into full ghost mode.

Moral of the story? Always vet buyers carefully, confirm financing sources early, and never count your deal as done until the ink is dry!

*Source KPMG 2024 M&A Deal Market Study

About Topsail Capital Advisors

Topsail Capital Advisors specializes in helping owners of privately held lower middle market businesses value and sell their companies. Our team provides expert guidance throughout the M&A process to ensure owners achieve the best possible outcome for their exit.

For more information, visit topsailcapitaladvisors.com or reach out to us at [email protected]

Stay tuned for next month’s insights!