The Official Newsletter of Topsail Capital Advisors on All Things Mergers and Acquisitions.

Executive Summary

PwC recently reported that while global M&A deal volume dropped 9% when comparing the first half of 2025 to the first half of 2024, overall deal value is up 15% year over year. A survey from PwC in May 2025 also reported that 30% of participants had paused or revisited a deal due to tariff uncertainty. While new uncertainties have been appearing in the M&A market, dealmakers are finding ways to navigate the ever-changing landscape to get deals done.

On This Day – Notable Acquisitions in the Month of June

June 4

2025 – Roark Capital, a private equity firm based in Atlanta, GA finalized their $1 billion acquisition of Dave’s Hot Chicken.

June 6

2018 – Northrup Grumman acquires Orbital ATK for $9.2 billion and changes its name to Northrup Grumman Innovation Systems.

June 10

2023 – Blackstone completes its acquisition of Tropical Smoothie Cafe for $2billion

June 12

2023 – Saint-Gobain acquires Building Products of Canada for $995 million.

2018 – Even through attempts by the DOJ to block the transaction, AT&T acquires Time Warner for $85 billion in media mega-merger

June 18

2025 – Nippon Steel finalizes their acquisition of US Steel.

June 19

2020 – Merck finalizes its acquisition of Themis Bioscience to bolster its development of a COVID-19 vaccine

June 23

2024 – Any Hour Services acquired McQuillan Home Services for an undisclosed amount showing continued desire for HVAC, plumbing, and electrical services

June 25

2024- Honeywell acquired Cobham Advanced Electronic Solutions for $1.9 billion. This acquisition greatly strengthened Honeywell’s position in the growing Aerospace industry

June 29

2023 – Cisco acquires Smartlook for an undisclosed amount, their third large acquisition in 2023

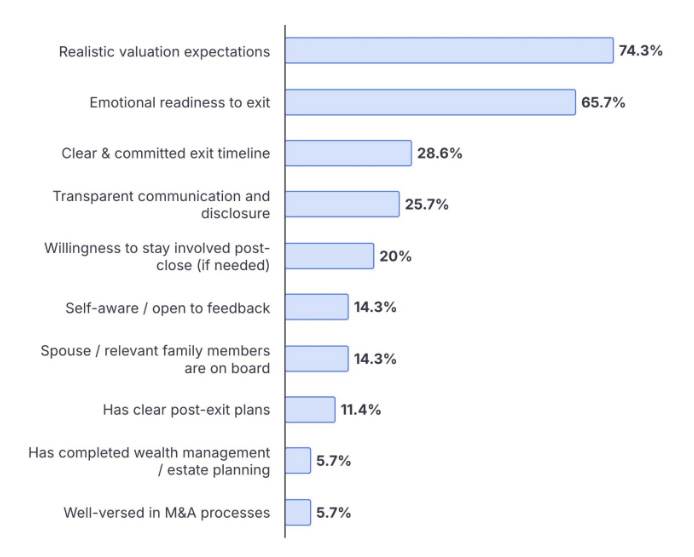

How do you know when you’re ready to exit your business?

Business owners spend a large portion of their life building their companies to a point of success, and there are many significant questions that arise when an owner considers selling what they have spent their life building. There are two questions that tend to stand out in everyone’s mind: How much money do I need to be happy and retire, and how much is my business really worth?

Eric Beck, CEO of Founder’s Fire, tackles the first of these two questions with his idea: Financial Escape Velocity.

How Much Is Enough?

We’ve all heard the question: “How much is enough?” For some, like John D. Rockefeller, the answer is “just a little bit more.” Others, like William Blake, suggest that “you never know what is enough unless you know what is more than enough.” Here’s the truth: understanding what is enough is the foundation for freedom. Money isn’t just a tool for survival—it’s a mirror reflecting what we value. Misusing it can lead to stress, anxiety, and even enslavement to the wrong systems. But when used wisely, money can be a means to create freedom—for ourselves and others.

Think of Financial Escape Velocity as breaking free from the traps of debt, constant consumption, and trading time for money. It’s a journey in three phases:

- Trading Time for Money: This is the work-to-live model, where we exchange time and health for paychecks, often with little ownership of our future.

- Trading Value for Money: By starting your own business or becoming an intrapreneur, you transition to creating value and working towards a vision that excites you. This phase is about owning your contribution to the world.

- Owning Your Source: This is where you take the profits you’ve generated and invest them in things that truly matter—your food, safety, community, and long-term independence. This stage is about using money to build freedom, not just accumulate wealth.

Valuation: Why your company needs it

Many business owners who are in the market to sell their company find themselves wondering where to start their journey. This question creates one of the greatest barriers between those looking to sell their companies and their prospective buyers. To demystify this problem, Topsail Capital Advisors provides a bespoke Valuation procedure that gives business owners the information they need to make future decisions for themselves and their companies. We refer to these as Market Valuation and Exit Plans in the world of Mergers & Acquisitions. In the words of wise men, “The journey of a thousand miles begins with a single step”. Valuation serves as the first step; below will define what the process entails and why it is necessary for success in the process of selling your company.

The Market Valuation and Exit Plan (MVEP) document provides the company owners with a wealth of information during the beginning of the transaction process. To simplify the process, the MVEP can be broken down into the following:

Overview:

- Summary of Business Operations

- This part of the document is what business owners know by heart: “What do we do?”

- While this may seem trivial, it gives the business owner an idea of what prospective buyers will see at first glance

- This provides insights for the business and the industry as a whole

- Opinion of Value

- This will provide a fair valuation range for your company based on the insights of Topsail’s exceptional analysts

- The Opinion of Value is based off the company’s past and present financials

- Methodology behind the valuation

- Financial Metrics utilized

- Adjustments made to reach the valuation price

- Financials

- Analytics

- Assesses relevant financials for the transaction process

- Focuses on potential opportunities or problem areas that may be addressed at the time of the valuation

- Forecasting

- Provides insight related to expected growth in the future

- Gives the business owner insight on how their business may be perceived by growth-minded buyers

- Analytics

- Approach

- Partner Profile

- This will give business owners an idea of what types of buyers would be interested in the company

- Offers typical aspects about buyer types and how they may go about proceedings during the transaction process

- Partner Profile

- Timeline

- Discloses what the transaction process would look like for the business owner

- Tailored to the company

- Takes similar companies that have sold in the past into account

- Discloses what the transaction process would look like for the business owner

The Importance of Valuation and Planning

In the midst of the 2008 financial crisis, Chicago faced major budget deficits, struggling to fund public programs and maintain city infrastructure. Instead of raising taxes, Mayor Richard Daley proposed an alternative solution: selling the city’s parking meters. By December 2008, the City of Chicago agreed to lease the rights to its 36,000 parking meters for 75 years in exchange for $1.15 billion.

Just seven months later, in June 2009, a report from the Office of the Inspector General conducting a full valuation on the city’s parking meters revealed that the meters had been undervalued by $974 million in the deal – nearly a 50% discount. By 2023, the private investors had already recovered their initial investment and earned an additional $500 million in profit, with 60 years still remaining on the lease.

This deal is widely regarded as the worst financial decision in the city of Chicago’s history; this serves as a cautionary tale about the risks of rushing into a purchase or sale without accurate valuation information and proper due diligence.

On the Lighter Note: The Name Game Negotiation

A small-town pet grooming business in North Carolina was up for sale, and everything was going smoothly—until the very end, when the seller threw in one last request: the buyer had to keep the business name exactly the same.

The name? “The Barking Lot.”

The buyer laughed, assuming it was negotiable, but the seller was dead serious. “I spent three weeks coming up with that name in 1998, and people still honk when they drive by. It’s part of the brand.”

Despite initial hesitation, the buyer agreed. After closing, not only did they keep the name—they leaned into it, repainting the entire storefront to look like a parking garage, complete with fake meters and tow-away signs for cats.

Lesson learned? In lower middle market deals, branding is serious business—even when it’s a pun.

About Topsail Capital Advisors

Topsail Capital Advisors specializes in helping owners of privately held mid-sized and lower middle-market business owners value and sell their companies. Our team provides expert guidance throughout the M&A process to ensure owners achieve the best possible outcome for their exit.

For more information, visit topsailcapitaladvisors.com or reach out to us at admin@topsailcapitaladvisors.com

Stay tuned for next month’s insights!